Welcome to BesteWallets.org, your go-to source for all things related to digital wallets. As technology continues to evolve, more and more people are turning to digital wallets as a convenient and secure way to manage their money.

Whether you’re looking for a way to store your credit cards, make online purchases, or send money to friends and family, a digital wallet can help simplify your financial life. At BesteWallets.org, we aim to provide you with comprehensive reviews and comparisons of the best digital wallets available on the market today.

Our team of experts has researched and tested each wallet to help you make an informed decision and find the perfect solution for your needs. So, whether you’re a seasoned user or just getting started with digital wallets, we’ve got you covered. Browse our site and discover the best digital wallets for your needs.

Skrill, Neteller, and Mifinity are widely regarded as the best e-wallets in the market due to their secure payment processing, extensive network of merchants, and user-friendly interfaces.

Best eWallets

| Muchbetter Read review | 150 currencies + Global | Go to site |

| Mifinity Read review | 150+ currencies + Global | Go to site |

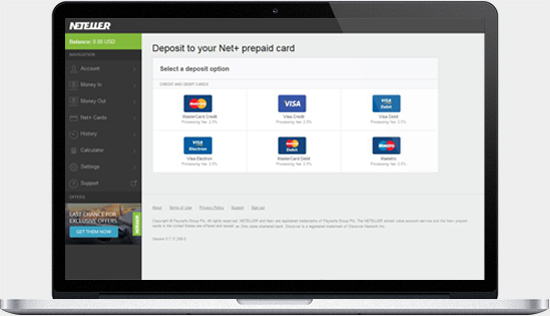

| Neteller Read review | 28 currencies + 200 countries | Go to site |

| Skrill Read review | 40+ currencies + 200 countries | Go to site |

Compare top 3 eWallets

| E-Wallet Provider | Skrill | Mifinity | Neteller | Muchbetter |

|---|---|---|---|---|

| Founded | 2001 | 2008 | 1999 | 2008 |

| Parent Company | Paysafe Group | Mifinity Corp | Paysafe Group | Mifinity Corp |

| Headquarters | London, UK | Dublin, Ireland | Isle of Man | Dublin, Ireland |

| Available Currencies | 40+ | 150+ | 28 | 150+ |

| Accepted Countries | 200+ | Global | 200+ | Global |

| Deposit Methods | Bank transfer, credit/debit card, Paysafecard, and more | Bank transfer, credit/debit card, cryptocurrency, and more | Bank transfer, credit/debit card, Paysafecard, and more | Bank transfer, credit/debit card, cryptocurrency, and more |

| Withdrawal Methods | Bank transfer, credit/debit card, and more | Bank transfer, credit/debit card, cryptocurrency, and more | Bank transfer, credit/debit card, and more | Bank transfer, credit/debit card, cryptocurrency, and more |

| Fees | 1.45% for international transactions, free for domestic | Free for most transactions, 2% for currency conversions | 2.5% for deposits, free for withdrawals | Free for most transactions, 2% for currency conversions |

| Security | Two-factor authentication, anti-fraud measures, encryption | Two-factor authentication, anti-fraud measures, encryption | Two-factor authentication, anti-fraud measures, encryption | Two-factor authentication, anti-fraud measures, encryption |

| Mobile App | Available for iOS and Android | Available for iOS and Android | Available for iOS and Android | Available for iOS and Android |

| Notable Features | Skrill Card, Skrill Knect loyalty program | Mifinity Virtual Prepaid Card, Mifinity Business Account | Net+ Prepaid Mastercard, Neteller VIP Program | MuchBetter Card, MuchBetter Rewards Program |

| 🏆 Best ewallet | Muchbetter |

| 🎰 Best ewallet for casinos | Skrill |

| ₿ Best ewallet for Bitcoin | Coinbase |

| 🎲 Best NZ casinos | Bestnzcasino.com |

How e-wallets work: A guide to digital payments

An e-wallet, also known as a digital wallet, is an online payment system that allows individuals to store and use electronic money for various transactions. Here’s how e-wallets typically work:

- Sign up: To start using an e-wallet, you need to sign up for an account with a provider of your choice. You will typically need to provide some basic information such as your name, email address, and phone number.

- Add funds: Once you have created an account, you can add funds to your e-wallet by linking it to your bank account, credit card, or debit card. Some e-wallets also allow you to add funds through other payment methods, such as cash deposits or money transfers.

- Make payments: Once you have funds in your e-wallet, you can use it to make payments for various services and products. This includes online shopping, bill payments, and peer-to-peer transfers. To make a payment, you simply need to select the e-wallet as your payment method and enter your password or PIN.

- Receive payments: You can also receive payments in your e-wallet from other individuals or businesses. For example, if someone owes you money, they can transfer it directly to your e-wallet.

- Security: E-wallets typically use advanced security measures such as two-factor authentication and encryption to protect your funds and personal information.

- Fees: E-wallets may charge fees for certain transactions, such as adding funds or withdrawing money. Make sure you understand the fees associated with your e-wallet before you start using it.

Overall, e-wallets are a convenient and secure way to make payments and manage your money online.

Funding your e-Wallet: Methods for adding money to your eWallet

E-wallets can be funded through various methods, depending on the service provider. Here are some of the most common ways:

- Bank transfers: Many e-wallets allow users to link their bank account and transfer funds directly to their digital wallet.

- Debit or credit cards: E-wallets can also be funded using debit or credit cards. You can add your card information to your e-wallet account, and the wallet will automatically deduct the funds from your card when you make a payment.

- Prepaid cards: Some e-wallet providers offer prepaid cards that can be loaded with funds and used to make purchases, just like a regular debit or credit card.

- Cash deposits: Some e-wallets allow you to add funds to your account by making a cash deposit at a participating location, such as a convenience store or bank.

- Cryptocurrencies: Some e-wallets allow users to fund their accounts using cryptocurrencies such as Bitcoin or Ethereum.

Once you have added funds to your e-wallet, you can use the balance to make purchases or send money to other users. It’s important to note that some e-wallets may charge fees for certain funding methods, so be sure to check the terms and conditions of your specific provider.

A guide to the various applications of digital wallets

- Online Shopping: Many e-commerce websites accept e-wallet payments as a fast and secure way to complete transactions.

- In-Store Purchases: Some brick-and-mortar stores and retailers accept e-wallet payments, particularly those with mobile payment capabilities like Apple Pay and Google Pay.

- Peer-to-Peer Transfers: E-wallets can be used to send and receive money between individuals or businesses, making it a convenient way to split expenses or pay for services.

- Bill Payments: Some e-wallets offer the ability to pay bills directly from the app, making it easier to manage finances and stay on top of monthly payments.

- Online Casinos: Many online casinos accept e-wallets as a form of payment, as they provide a fast and secure way to make deposits and withdrawals.

Casino Tips:

Fast casino payout is an independent casino guide that compares casinos based on how fast withdrawals they offer. Here you can find New Zealand’s fastest paying operators.

Balkan Gamblers – The best casino guide in Balkan! Find the best casino with local license and currencies!

What we look at when we compare eWallets

- Security: The best e-wallets use advanced encryption technology to protect users’ personal and financial information from unauthorized access and fraud.

- Convenience: E-wallets are designed to be easy to use, with simple and intuitive interfaces that allow users to make transactions quickly and easily.

- Compatibility: The best e-wallets are compatible with a wide range of devices and platforms, including mobile devices, laptops, and desktops.

- Speed: E-wallets offer fast and efficient transactions, allowing users to make payments and transfers in real-time.

- Customer support: The best e-wallet providers offer reliable and responsive customer support, with multiple channels of communication and knowledgeable support staff.

- Integration: Many e-wallets integrate with other payment systems and services, allowing users to link multiple accounts and make transactions across different platforms.

- Low fees: The best e-wallets have low or no fees for transactions, making them a cost-effective alternative to traditional payment methods.

FAQ

E-wallets, also known as digital wallets, are online payment systems that allow individuals to store and use electronic money for various transactions. They are essentially a digital version of a physical wallet that allows you to make payments and manage your finances through a mobile app or website. E-wallets can be used to make payments for various services and products, including online shopping, bill payments, and peer-to-peer transfers. They typically offer advanced security measures such as encryption and two-factor authentication to protect your funds and personal information. E-wallets have become increasingly popular as they offer a convenient, fast, and secure way to manage your money online.

E-wallets are generally safe to use, as they use advanced security measures such as encryption and biometric authentication to protect your funds and personal information. However, it is important to choose a reputable e-wallet provider and take basic security measures such as setting a strong password and not sharing your login information.

Yes, e-wallets are commonly used for online shopping as they offer a convenient and secure way to make payments. Many online merchants accept e-wallet payments, and some e-wallets even offer exclusive deals and promotions for online shopping.