Crypto wallets are essential tools for anyone engaging with cryptocurrencies. These digital wallets provide a secure and convenient way to store, send, and receive digital assets like Bitcoin, Ethereum, and more. By utilizing cryptographic technology, crypto wallets ensure the safety and control of your digital wealth.

With the increasing adoption of cryptocurrencies, understanding how crypto wallets work is crucial for safeguarding your digital assets. In this guide, we will explore the fundamentals of crypto wallets, their types, and the importance of security measures. Whether you’re a beginner or an experienced crypto user, this overview will help you navigate the world of crypto wallets and make informed decisions to protect and manage your digital wealth effectively.

Best Crypto wallets

| CoinBase Read review | $10 of Bitcoin FREE + Wallet & NFT | Go to site |

| Skrill Read review | 40+ currencies + 200 countries | Go to site |

| Mifinity Read review | 150+ currencies + Global | Go to site |

Comparison of Top eWallets: Coinbase, Skrill, and MiFinity

| Coinbase | Skrill | MiFinity | |

|---|---|---|---|

| Key Features | – Secure crypto storage and trading | – Wide range of payment options | – Multicurrency support |

| – User-friendly interface | – Instant money transfers | – Prepaid Mastercard for convenient use | |

| – Mobile app for on-the-go access | – Integration with online merchants | – P2P money transfers | |

| Fees | – Variable fees depending on transaction type and region | – Transaction fees for certain services | – Competitive fees for international transfers |

| Supported Currencies | – Bitcoin, Ethereum, Litecoin, and more | – 40+ fiat currencies and multiple cryptocurrencies | – Wide range of fiat currencies and cryptocurrencies |

| Advantages | – Trusted and regulated platform | – Established and widely accepted | – Multicurrency options for global users |

| – Convenient mobile app | – Diverse payment options | – Prepaid Mastercard for easy spending | |

| – User-friendly and intuitive interface | – International money transfers | – Secure P2P money transfers | |

| Disadvantages | – Limited range of supported cryptocurrencies | – Some services may have higher fees | – Limited availability in certain regions |

| – Limited availability in some countries | – Restricted usage for certain industries | – Limited cryptocurrency support |

Crypto Wallets Criteria for Evaluation: Factors to Consider

When evaluating and choosing a crypto wallet, it’s important to consider several key criteria to ensure that it aligns with your needs and provides a secure and convenient storage solution for your digital assets. Here are some essential factors to consider when evaluating crypto wallets:

- Security: The security of your digital assets is paramount. Look for wallets that offer robust security features such as encryption, two-factor authentication (2FA), and biometric authentication. Wallets that allow you to retain full control of your private keys are preferred as they reduce the risk of unauthorized access.

- User-Friendliness: A user-friendly interface and intuitive design can greatly enhance your wallet experience. Look for wallets that offer a seamless and easy-to-navigate user interface, making it simple to send, receive, and manage your cryptocurrencies.

- Supported Currencies: Check which cryptocurrencies the wallet supports. While many wallets offer support for popular cryptocurrencies like Bitcoin and Ethereum, not all wallets support a wide range of digital assets. Ensure that the wallet supports the specific cryptocurrencies you intend to store or trade.

- Compatibility and Accessibility: Consider the compatibility of the wallet with your devices and operating systems. Look for wallets that are available on multiple platforms such as desktop, mobile, and web. Cross-platform accessibility ensures that you can access your funds conveniently from various devices.

- Integration with Exchanges and Services: Some wallets offer integration with cryptocurrency exchanges, allowing you to seamlessly trade and exchange digital assets within the wallet interface. Integration with other services like decentralized applications (DApps) or blockchain platforms can also enhance functionality and utility.

- Fees: Evaluate the fee structure of the wallet, including transaction fees, network fees, and conversion fees for different currencies. While some wallets offer competitive or even zero fees, others may charge higher fees for certain transactions or services.

- Backup and Recovery Options: Consider the wallet’s backup and recovery mechanisms. Look for wallets that provide backup phrases or seed words, which can be used to restore your wallet and access your funds in case of device loss or failure.

- Development Team and Community Support: Research the wallet’s development team and their track record. A reputable and active development team, along with a supportive community, indicates ongoing updates, bug fixes, and security enhancements for the wallet.

- Customer Support: Reliable customer support can be crucial when encountering issues or needing assistance with your wallet. Check if the wallet offers responsive customer support channels, such as email, live chat, or community forums.

Security and Privacy: Safeguarding Your Crypto Wallet

When it comes to managing your digital assets, security and privacy are of utmost importance. Crypto wallets understand the need for robust security measures to protect your valuable cryptocurrencies from unauthorized access and potential threats. Here, we delve into the security and privacy features implemented by eWallet providers to ensure the safety of your funds.

Encryption: Leading eWallet providers utilize strong encryption protocols to secure your wallet’s private keys and transaction data. Encryption algorithms scramble your sensitive information, making it nearly impossible for hackers to decipher or intercept your data.

Two-Factor Authentication (2FA): Many crypto wallets offer 2FA as an additional layer of security. By enabling 2FA, you add an extra step to the login process, typically involving a verification code sent to your registered mobile device. This helps prevent unauthorized access to your wallet, even if someone manages to obtain your login credentials.

Biometric Authentication: Some eWallets support biometric authentication, such as fingerprint or facial recognition, on compatible devices. Biometrics provide an added level of convenience and security by ensuring that only you can access your wallet.

Offline Storage: Hardware wallets, a type of crypto wallet, offer an extra layer of security by storing your private keys offline. As they are not connected to the internet except during transactions, hardware wallets significantly reduce the risk of online threats like hacking or phishing attacks.

Backup and Recovery: Crypto wallets often provide backup and recovery options to safeguard against device loss or failure. Wallets generate a set of seed words or a recovery phrase during the setup process. It’s crucial to securely store this information, as it can be used to restore your wallet and access your funds if needed.

Data Protection Policies: Reputable eWallet providers prioritize user privacy and implement stringent data protection policies. They adhere to industry best practices and regulations to safeguard your personal information and transaction data from unauthorized access or misuse.

Regular Updates and Security Audits: Trusted eWallet providers regularly release updates to address potential vulnerabilities and enhance the security of their platforms. They may also undergo third-party security audits to ensure compliance with industry standards and best practices.

While eWallet providers take significant measures to enhance security, it’s essential for users to maintain good security practices as well. This includes regularly updating your wallet software, using strong and unique passwords, enabling security features like 2FA, and being cautious of phishing attempts or suspicious links.

Fees and Charges: Understanding the Costs of Using Crypto Wallets

When using crypto wallets, it’s important to be aware of the various fees and charges that may be associated with their services. Understanding these costs upfront allows you to make informed decisions and manage your digital assets effectively. Here, we outline the common types of fees you may encounter when using eWallets.

Transaction Fees: Most crypto wallets charge transaction fees for sending or receiving cryptocurrencies. These fees can vary depending on factors such as network congestion, transaction size, and the cryptocurrency being used. It’s worth noting that transaction fees are typically paid to miners or validators who process and verify transactions on the blockchain network.

Currency Conversion Fees: If you need to convert between different cryptocurrencies or fiat currencies within your wallet, currency conversion fees may apply. These fees cover the costs associated with liquidity providers or exchanges used for currency conversions. The conversion fees can vary depending on the specific currencies involved and market conditions.

Network Fees: Crypto transactions often require network fees, also known as gas fees or blockchain fees, to ensure priority processing on the blockchain network. These fees are set by the respective blockchain networks and are typically paid in the native cryptocurrency. The amount of network fees can fluctuate based on network congestion and transaction priority.

Withdrawal Fees: If you plan to withdraw funds from your crypto wallet to an external wallet or bank account, withdrawal fees may apply. These fees cover the costs associated with processing the withdrawal and transferring funds to your desired destination. Withdrawal fees can vary depending on the cryptocurrency or fiat currency involved and the withdrawal method chosen.

Exchange Fees: Some crypto wallets offer integrated exchange services, allowing you to trade or swap cryptocurrencies within the wallet interface. Exchange fees may apply for these transactions, which can include trading fees, spread fees, or commission fees. The fee structure can vary depending on the specific wallet and exchange platform integrated into the wallet.

Third-Party Service Fees: In addition to the fees charged by the crypto wallet provider, certain third-party services integrated within the wallet may also have their own fees. For example, if your wallet offers the option to purchase cryptocurrencies directly using a credit card, additional fees or charges may be applicable for that service.

Conclusion: Choosing the Right Crypto Wallet for Your Digital Assets

In this article, we have explored the world of crypto wallets and their significance in managing and safeguarding your digital assets. We have discussed the benefits they offer, including secure storage, ease of use, and accessibility. Additionally, we have examined three popular crypto wallet options: Coinbase, Skrill, and MiFinity, considering their features, fees, user experience, security, and our recommendations.

When selecting a crypto wallet, it is important to evaluate key factors to ensure it meets your specific needs. Consider criteria such as security measures, fees and charges, supported cryptocurrencies, user experience, customer support, and additional features like integration with exchanges or payment services.

Fees and charges associated with crypto wallets can vary, including transaction fees, currency conversion fees, withdrawal fees, and network fees. Being aware of these costs upfront allows you to plan and manage your digital assets effectively.

In conclusion, selecting the right crypto wallet is crucial in maintaining the security and accessibility of your digital assets. By understanding the features, fees, and security measures offered by different wallets, you can make an informed decision that aligns with your preferences and requirements. Remember to prioritize security, user experience, and the specific needs of your cryptocurrency portfolio when choosing a crypto wallet.

FAQ

A crypto wallet is a digital wallet that allows users to securely store, manage, and transact with cryptocurrencies. It stores the user’s public and private keys, enabling them to send, receive, and monitor their digital assets.

When choosing a crypto wallet, consider factors such as security features, supported cryptocurrencies, user interface, backup and recovery options, and compatibility with your devices. Assess your needs and preferences to find a wallet that aligns with your requirements.

Crypto wallets prioritize security by implementing encryption, two-factor authentication, and offline storage mechanisms. However, it is essential to choose reputable wallets, follow best security practices, and protect your private keys to ensure the safety of your digital assets.

Some wallets support a wide range of cryptocurrencies, while others are limited to specific ones. It’s important to check the wallet’s supported currencies and ensure compatibility with the cryptocurrencies you intend to use.

Crypto wallets may charge transaction fees, currency conversion fees, withdrawal fees, or exchange fees. The fee structures can vary between wallets, so it’s important to review the specific fees and charges associated with each wallet.

Many crypto wallets offer multi-device accessibility through mobile apps, web interfaces, or desktop applications. Ensure that your chosen wallet supports your desired devices and provides secure synchronization across them.

Losing access to your crypto wallet can result in permanent loss of funds. It’s crucial to follow backup and recovery procedures provided by the wallet, such as storing your recovery phrase in a secure place. Always keep a backup to restore your wallet if needed.

Traditional eWallets typically offer certain levels of consumer protection or insurance. However, crypto wallets generally do not offer the same level of insurance coverage. It’s important to understand the wallet’s terms and conditions regarding liability and insurance coverage.

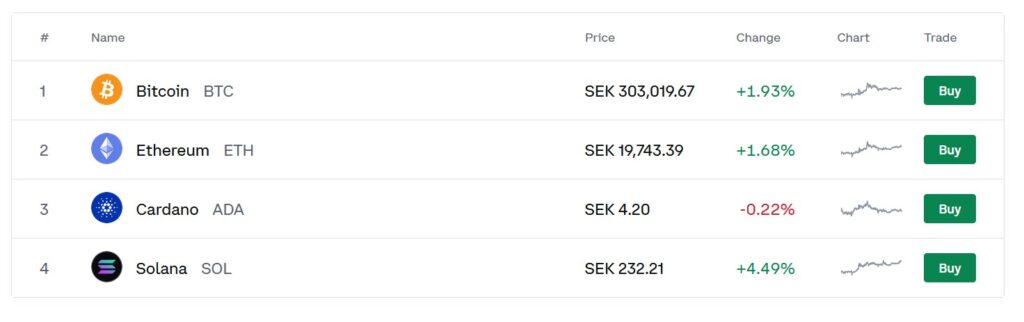

No there are many countries around the world that do not allow crypto currencies but even so people use it anyway since its not easy for the goverment to see crypto transactions. In Sweden for ex according to bäst online casino Bitcoins are not legal but there is no specific law for it so Swedes use this loophole to buy and sell crypto. They are considered as the people that uses crypto most in the world and still there is no law for it. In order to know if its legal in your country make sure to search for an answer that is specific for your country.